As of Friday, Nov. 29, the U.S., and much of the industrialized world, will go on a month-long spending spree that will break their budgets, put them in debt, and help the economy grow, all at the same time.

We have a list of the best personal finance apps for iPhone that we think might be helpful to you this holiday season. If you are living from one paycheck to the next, you might need one of these helpful budget trackers…

Mint.com

Many people have multiple accounts with multiple bills that are automatically withdrawn each month. Sometimes, you need a complex personal finance app to help you keep all eyes on all accounts. Mint allows you to track, budget, and manage money from various bank accounts all in one place. You can add multiple banks, credit cards, loans, and retirement accounts. This app automatically pulls in information and categorizes your transactions. You can check out an overview of your monthly spending using the included charts and graphs. Let Mint customize your budget based on your actual spending. Set up bill reminders, alerts, and advice so you will never miss a payment again. This app is available for free.

Spendee

With this simple personal finance tracker, users can easily keep track of daily, weekly, and monthly spending. It is great for people who hate balancing their budget, but always seem to get behind with money every month. Instead of having too many features with too many options, users are limited to categories like car, travel, bills, entertainment, etc. Then, add an income or expense amount and you are ready to go. Thanks to the apps’ graphic chart feature, you can see where you are spending too much and where you need to cut back.This app is available for $1.99.

Level Money

If you are somewhere between needing to track multiple bank accounts and wanting a simple personal finance app without many bells and whistles, Level Money is up your alley. It allows users to add multiple accounts from a huge list of banking establishments. The app automatically detects income and fixed expenses so that you can quickly see your monthly budget. Use the at-a-glance feature to see how this month’s cash flow is doing. Set up daily, weekly, and monthly budget and keep track of when you are going over. It is like counting calories when you are on a diet. This app is available for free.

BUDGT

If you don’t need to link your bank accounts, but you still want to keep track of daily expenses, this app may be more to your liking. All you have to do is enter your daily expenses and the app will do the math for you. You can create your own budget to keep track of where you should be each month. Create and manage your own categories, set reminders, and check end of month projections. You can go back and add expenses after the fact, so you won’t feel obligated to check in every single day. This app also updates currencies when you go to a different country. You can turn on Travel mode to enable currency conversions as well. This app is available for $0.99.

Dollarbird

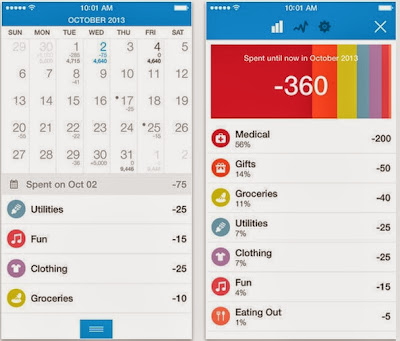

I have to admit that I’ve been in love with this app since I reviewed it last month. It is very similar to Spendee, but features one addition that, to me, makes it a great simplistic personal finance app. The calendar puts your month’s spending into a big picture display. Each day, you add your daily income and expenses. You can also add recurring items for future financial transactions. Then, check the last day of the month every time you add an income or expense to see what you will probably end up with at the end. If it looks like you might overspend, cut back on purchases for a few days. You can also see a chart of where your money goes each month. If you see that you are spending too much on going out to eat, maybe it’s time to start going to the grocery store more often. This app is available for $1.99.

Square Cash

I have a group of friends who pay what they owe each other in rent and bills each month using Square’s personal payment app. I’ve used Square to receive payment for working at a convention. I know people who have used it to buy and sell items on Craigslist. To receive money through Square Cash, all you need is the app, a US bank debit card or bank account number and an email address. When someone sends you money, Square will deposit it into your bank account for you. Sending money through Square Cash is just as easy. Just tap the “send cash” tab and enter at least one dollar. Then, attach the email with the recipient’s name and he or she will be sent an email with the amount attached. As long as both sender and recipient have a bank account linked to Square Cash, everything works smoothly. This app is available for free.

Pocket Expense

This personal finance app is a full-featured finance software that you carry in your pocket. It’s like having an accountant sitting on your shoulder. You can combine multiple accounts, including banks, credit cards, and loans into one convenient place. Plus, categorize transactions, keep track of bills, and set a budget so you don’t overspend. You can even set savings goals if you are hoping to set aside money each month for that new car you’ve been dreaming about. This app supports multiple budgets so you can track specific areas of finance instead of everything you spend each month. Plus, set up reminders and alerts for bills and keep track of them on the calendar to see when they are due. This app is available for $4.99.

MoneyWiz

MoneyWiz is a cross platform personal finance app, keeping all information synced over iPhone, iPad, or OS X. Using a MoneyWiz account, simply logging into the app on any device. Main sections include Accounts, Budgets, Schedule, and Reports. Accounts tracks individual expenses for checking/savings/market options with incomes, transfers between known accounts, balance adjustments, and even reconciliation options. Budgeting is account dependent, specific amounts are set for spending, and will roll remaining dollars at month’s end. Spending allowances are set on user specified times, giving a daily amount per budget. Scheduling provides a way to monitor reoccurring expenses and Reports keep things graphical with trending views and helpful charts. Offering both streamlined and spreadsheet layouts, most customers will be pleased with the operability. Locations and types of spending are added to the individual account users database, allowing autocomplete for entries across platforms. The UI, while not yet iOS 7 compliant, is extremely attractive and very Apple inspired. MoneyWiz is available for iPhone $4.99, iPad $4.99, and OS X $24.99, requiring a hefty buy-in for each device, but with syncing and many features, including export, the package is worth it for personal finance gurus.

No comments:

Post a Comment